Mergers & Acquisitions – our holistic approach for your successful transaction

Acquisitions or sales of companies or stocks and restructurings, known as M&A transactions, usually take place for strategic or economic reasons:

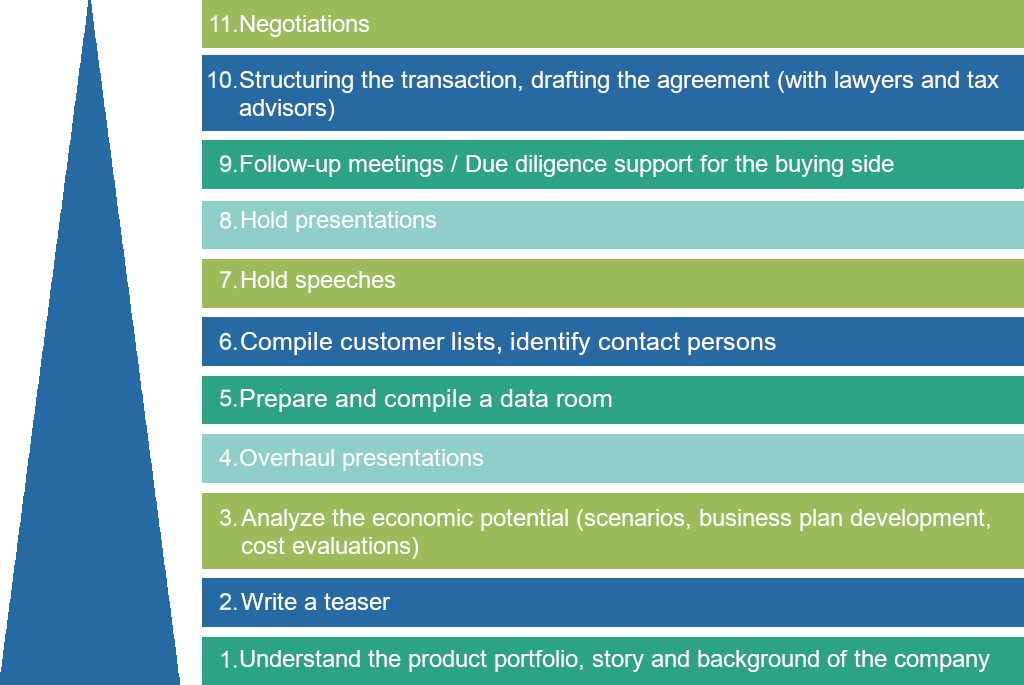

M&A transactions are a long process with different phases:

Target search, valuation, negotiation, and conclusion.

This complex process requires the involvement of several parties such as lawyers, auditors, investment bankers and business consultants. The high number of failed M&A transactions show how challenging and risky this process can be.

BrainFleet members have experienced M&A transactions in their own companies or as advisors for other companies and have deep and broad expertise to share.

High relevance of early M&A preparation

A merger of companies has an impact on the business continuity and especially on the employees.

With our interdisciplinary know-how we ensure the preparation of the sale or acquisition is carried out successfully. We are the right partner for the preparation and planning of the necessary steps in your M&A transaction process.

After conclusion of the transaction we provide integration coaching to help you with the post-merger integration which is vital to keep your business successful on the long run.

This way we make sure to maintain a positive business culture and communication as well as to retain the employees and the knowledge and make your business thrive.

If you are planning to go public our BrainFleet experts will help you plan and prepare the steps of the IPO from the IPO readiness assessment to due diligence and the complex post-IPO phase. Further, we help you establish and monitor process routines in your company to ensure the compliance with disclosure and reporting requirements.

For a successful IPO you need the support of investment bankers, specialized lawyers and auditors which can cause considerable costs. We help you with cost optimization, organize pitches and recommend you the right partners for your IPO and will also support the service providers you engage. The cost savings through the selection of the right service providers will exceed the costs for our optimization service significantly.

With BrainFleet at your side you will not only benefit from a wide range of services but also save money. Remember, many M&A deals fail just because of poor cooperation between lawyers, bankers and other advisors involved. With our full advice service, you will be spared of dealing with this risky challenge by yourself.

Trust our BrainFleet experts when planning an M&A or an IPO and contact us!

Acquisition

Every acquisition must be carefully prepared. The core elements of the valuation of the company and the successfully transaction are the analysis of strengths and weaknesses of the company to be sold and a correct assessment of potential buyers. We support you during the entire process right from the start: from the valuation to feasibility assessment, conclusion and beyond.

BrainFleet members are involved in different phases of the selling process:

The first hurdle is the choice of a competent partner who plans and monitors the entire sale process. And this is exactly what BrainFleet offers: an efficient and successful sale process through professional consulting services during the entire process. If necessary, we involve experts from outside. Through our competent advice we develop efficient solutions for your sale process to achieve the highest price possible for your company. Our top priority is integrity and discretion.

Same applies for acquisitions.

So, take no risk and trust BrainFleet when planning your M&A deal.

Restructuring/Reorganization advice – efficient stabilization of your business processes

Every restructuring bears high risks for your business no matter if small reorganization measures, the improvement of organizational or economic aspects or in worst cases the overcoming of a major crisis.

Due to our comprehensive expertise and special skills we help our clients stabilize their businesses fast and at the same time ensure a sustainable economic and operational transition. This creates trust and value among important stakeholders. We concentrate on sustainable value creation and develop customized, operational models for your business. This is what the BFM network stands for: achieving sustainable success for our clients – competent and objective.